The Truth About Institutional Landlords in Charleston

You’ve probably seen the alarming headlines claiming, “44% of all single-family home purchases were made by private investors in 2023.” But when we dive into the actual data, a different story emerges—one that paints a much clearer and less sensational picture of the housing market, both nationally and here in Charleston, SC.

The Reality Behind the Numbers

When we talk about investors in the housing market, it's essential to distinguish between institutional investors—those owning over 1,000 homes—and smaller, so-called "mom-and-pop" investors who typically own between two and nine homes. Despite the attention-grabbing headlines, the reality is that institutional investors make up only a tiny fraction of the overall market.

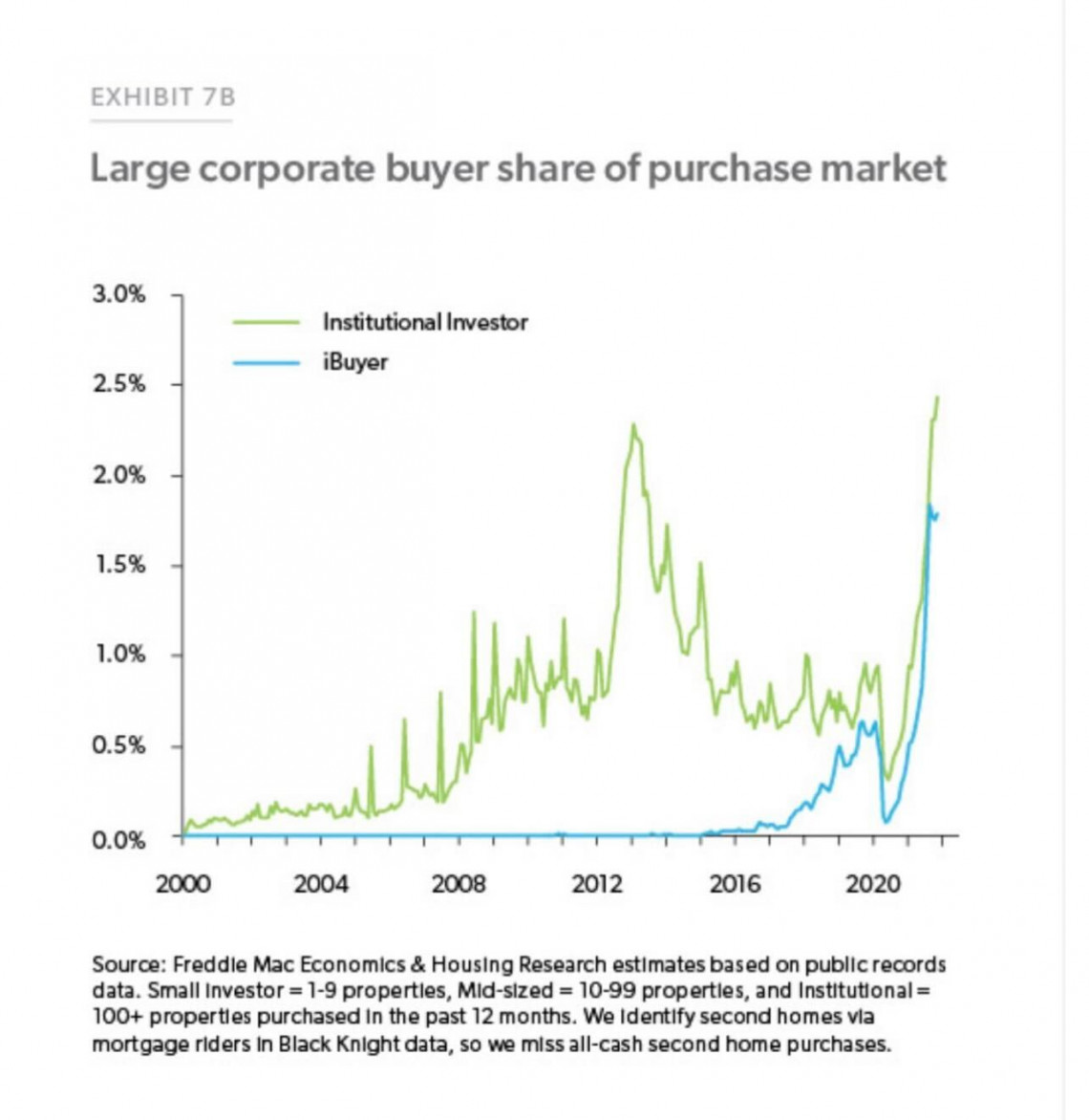

Take a look at the chart below from Freddie Mac, which shows that institutional investor purchases have consistently been a small slice of the total home sales in America. Even at their peak, these purchases accounted for less than 2.5% of the entire market.

Where Do Institutional Investors Own the Most Homes?

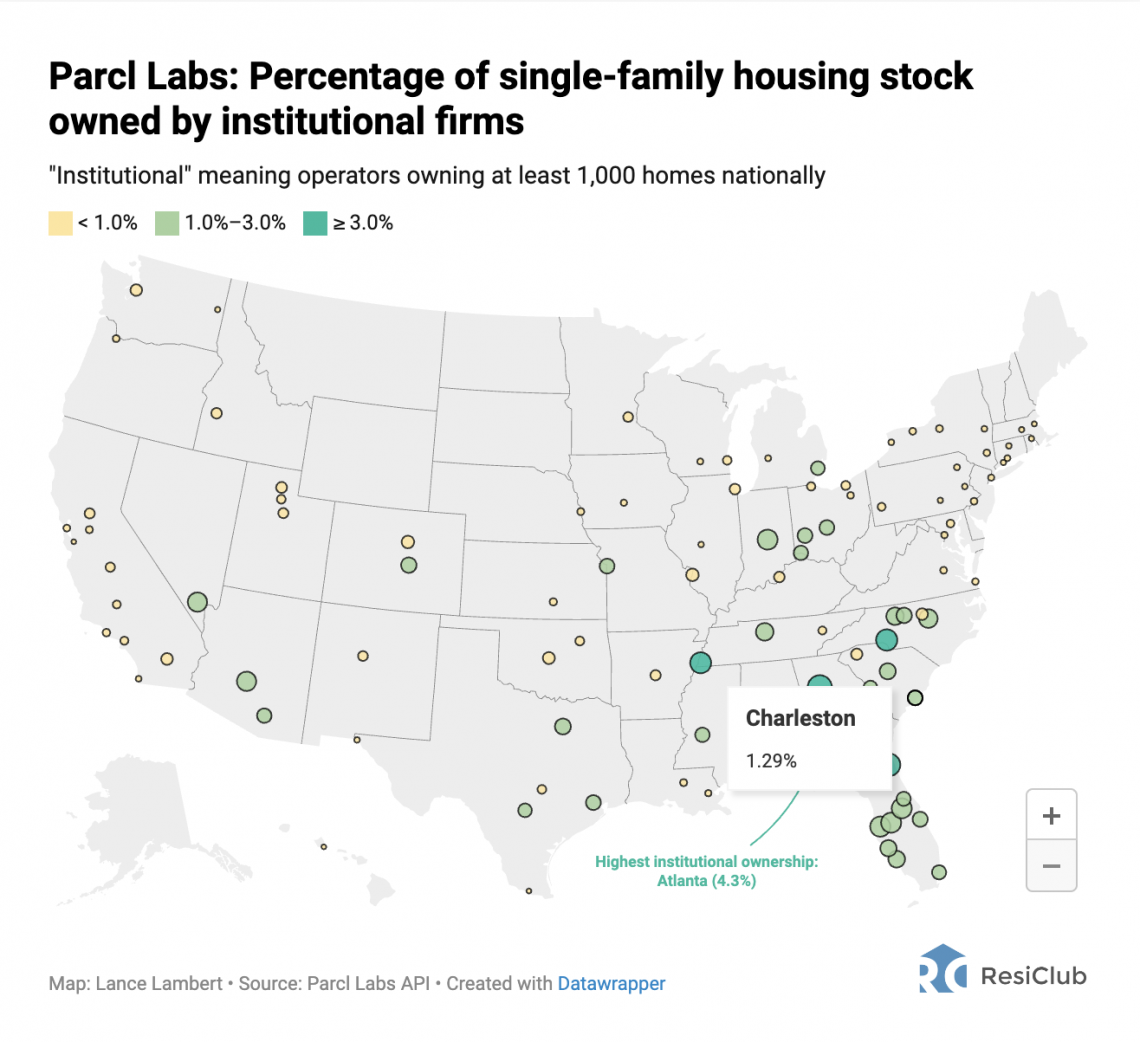

To put things into perspective, let’s examine where institutional investors have the highest share of homeownership. According to data from ResiClub and Parcl Labs, here are the top 10 U.S. markets with the largest share of institutional investor-owned homes:

- Atlanta, GA (4.3%)

- Jacksonville, FL (3.8%)

- Charlotte, NC (3.2%)

- Memphis, TN (3.1%)

- Tampa, FL (2.8%)

- Lakeland, FL (2.8%)

- Orlando, FL (2.8%)

- Indianapolis, IN (2.8%)

- Phoenix, AZ (2.6%)

- Las Vegas, NV (2.5%)

Even in Atlanta, where institutional ownership is the highest in the country, these entities still control less than 5% of the housing market.

Charleston's Market: A Closer Look

Here in Charleston, institutional investors own just 1.29% of the total housing stock—a figure far lower than many might expect given the recent media coverage.

The Real Players: Mom-and-Pop Investors

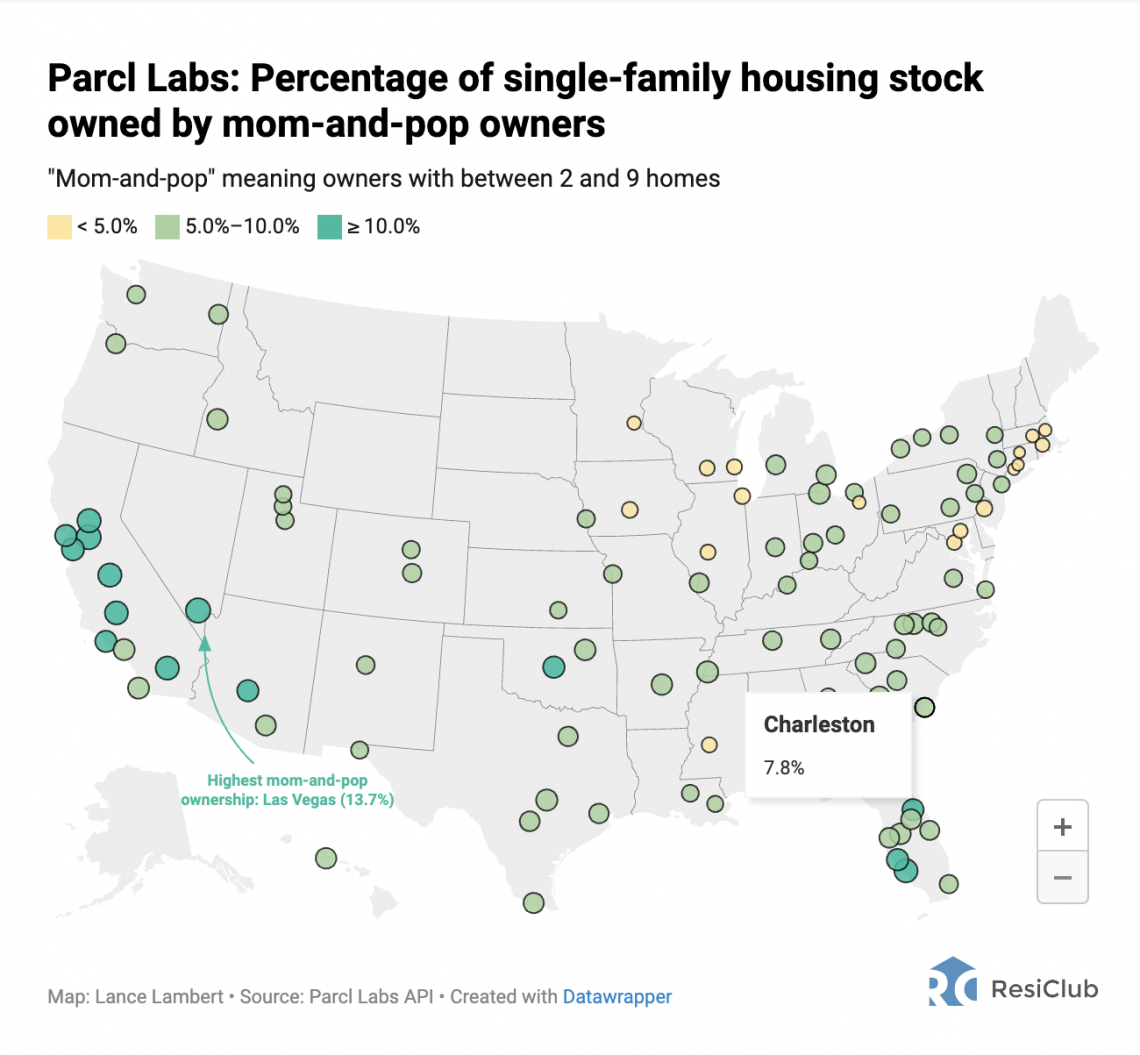

While institutional investors receive much of the attention, it's actually the smaller, mom-and-pop investors who own a significant portion of the housing stock across the country. According to the same analysis from ResiClub and Parcl Labs, here are the top 10 markets where these smaller investors hold the largest share:

- Las Vegas, NV (13.7%)

- Stockton, CA (13.5%)

- Sacramento, CA (12.4%)

- Fresno, CA (12.4%)

- Cape Coral, FL (12.3%)

- Riverside, CA (12.2%)

- Bakersfield, CA (12.0%)

- San Jose, CA (11.1%)

- North Port, FL (10.3%)

- Oklahoma City, OK (10.2%)

In Charleston, mom-and-pop investors own 7.8% of the housing stock, a substantial figure that underscores their importance in the local market.

The Bottom Line for Homebuyers

If you're worried about competing with Wall Street for a home, you might be focusing on the wrong target. The reality is that your biggest competitors are likely other individuals, whether it's your co-worker who’s also a first-time homebuyer or your neighbor looking to purchase their first investment property. Wall Street’s influence is out there, but it’s just a sliver of a very large market.

Curious about your home's value and what's happening in your neighborhood?

Get in touch. National numbers are a great measuring stick to see how the overall economy and housing market are doing, but they don’t account for local home values and your personal financial situation.

.png)

_w.png)

.png)