The Importance of Flood Insurance for Charleston area Property Owners

Despite the increasing frequency of severe storms and floods in South Carolina, many property owners are not securing the necessary flood insurance. Recent data from FEMA, reported by the Post and Courier, shows a concerning decline in the number of flood insurance policies across the state, even as development along the coast continues to surge. As of July 31, only 199,324 properties, or about 8% of all residential properties in South Carolina, are covered under the National Flood Insurance Program (NFIP). This number has dropped by 2,600 policies from the previous year. In Charleston County, 62,289 residential properties carry flood policies, followed by 7,316 in Berkeley County, and 3,059 in Dorchester County. I would love to see these numbers increase significantly and I will explain why below.

Financial Implications

The reluctance to purchase flood insurance seems to boil down to cost. Flood insurance premiums can be expensive, ranging from hundreds to thousands of dollars annually, depending on the property. Yet, without this coverage, homeowners are left vulnerable to significant financial loss in the event of a flood. For those who do not purchase insurance, out-of-pocket expenses or reliance on government disaster assistance are the only options if their property suffers flood damage.

Changes in Flood Insurance Pricing

Compounding the issue, changes in the way the government sets flood insurance rates have made the policies even more unaffordable for many. The "Risk Rating 2.0" initiative, launched in 2021, adjusts premiums based on a variety of factors beyond just elevation and location, resulting in higher costs for many policyholders. This new model has faced criticism, with South Carolina joining other states in a lawsuit to block the reforms, arguing that the changes could depress property values and harm local economies. Check out my previous blog on homeowners insurance for more info and recommendations.

The Importance of Being Prepared

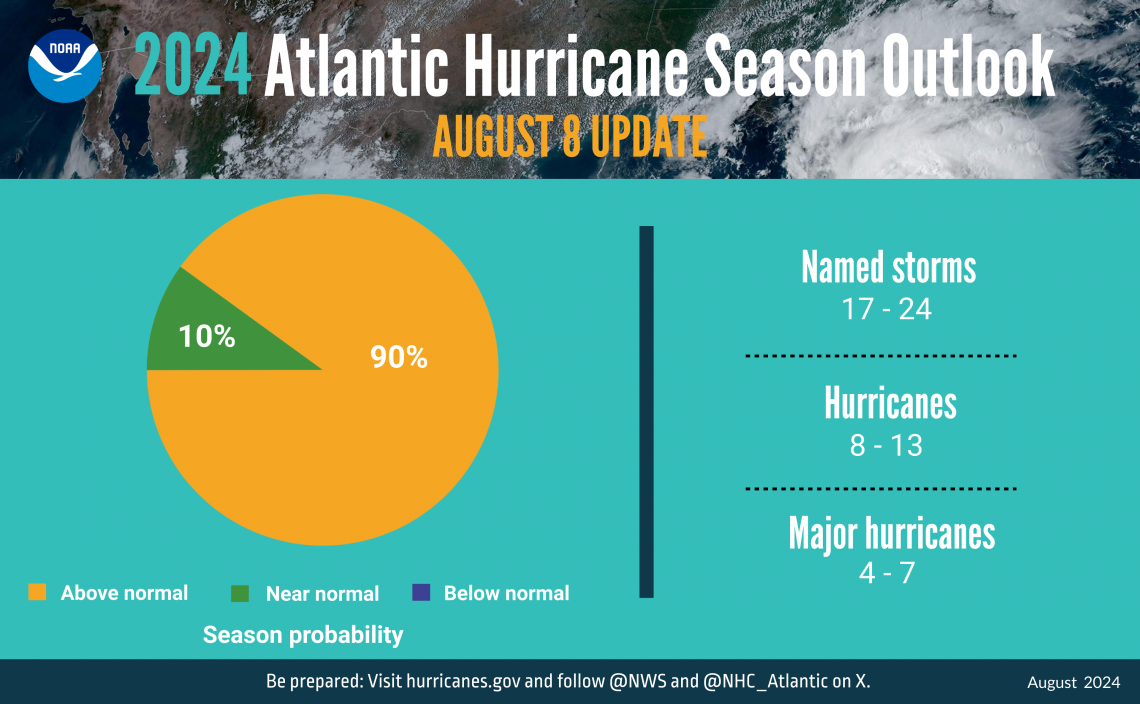

With storms like Tropical Storm Debby causing significant flooding, the South Carolina Department of Insurance is urging residents to consider flood insurance before the next event strikes. The reality is that flooding can happen anywhere, and being unprepared could lead to devastating financial consequences. This year especially, NOAA is forecasting a much busier hurricane season than recent years, as you can see in the graphic below.

Conclusion

As a real estate professional in Charleston, it is crucial to educate my clients on the importance of flood insurance. I encourage you to assess your risks and consider the long-term benefits of being protected against the inevitable storms that affect our beautiful state. Even if your home is in flood zone X, which isn't required by FEMA to carry flood insurance, I still highly recommend that you carry a flood insurance policy. Flood insurance might seem like a significant upfront cost, but it is a vital safeguard against potential financial ruin.

Curious about your home's value and what's happening in your neighborhood?

Get in touch. National numbers are a great measuring stick to see how the overall economy and housing market are doing, but they don’t account for local home values and your personal financial situation.

.png)

_w.png)

.png)