Charleston Home Prices: Where have we been and where are we going?

In the dynamic world of real estate, understanding past trends and anticipating future movements is key to making informed decisions. Since 2017, Charleston’s housing market has experienced significant changes, driven by a variety of economic factors and evolving buyer preferences. As we delve into the data from the past seven years, we’ll explore how home prices have shifted and what these trends might mean for the next 12 months leading up to July 2025. Whether you’re a potential buyer, seller, or investor, this analysis will offer valuable insights to guide your next move in the Charleston market.

All data used here is from ResiClub and Zillow: here and here.

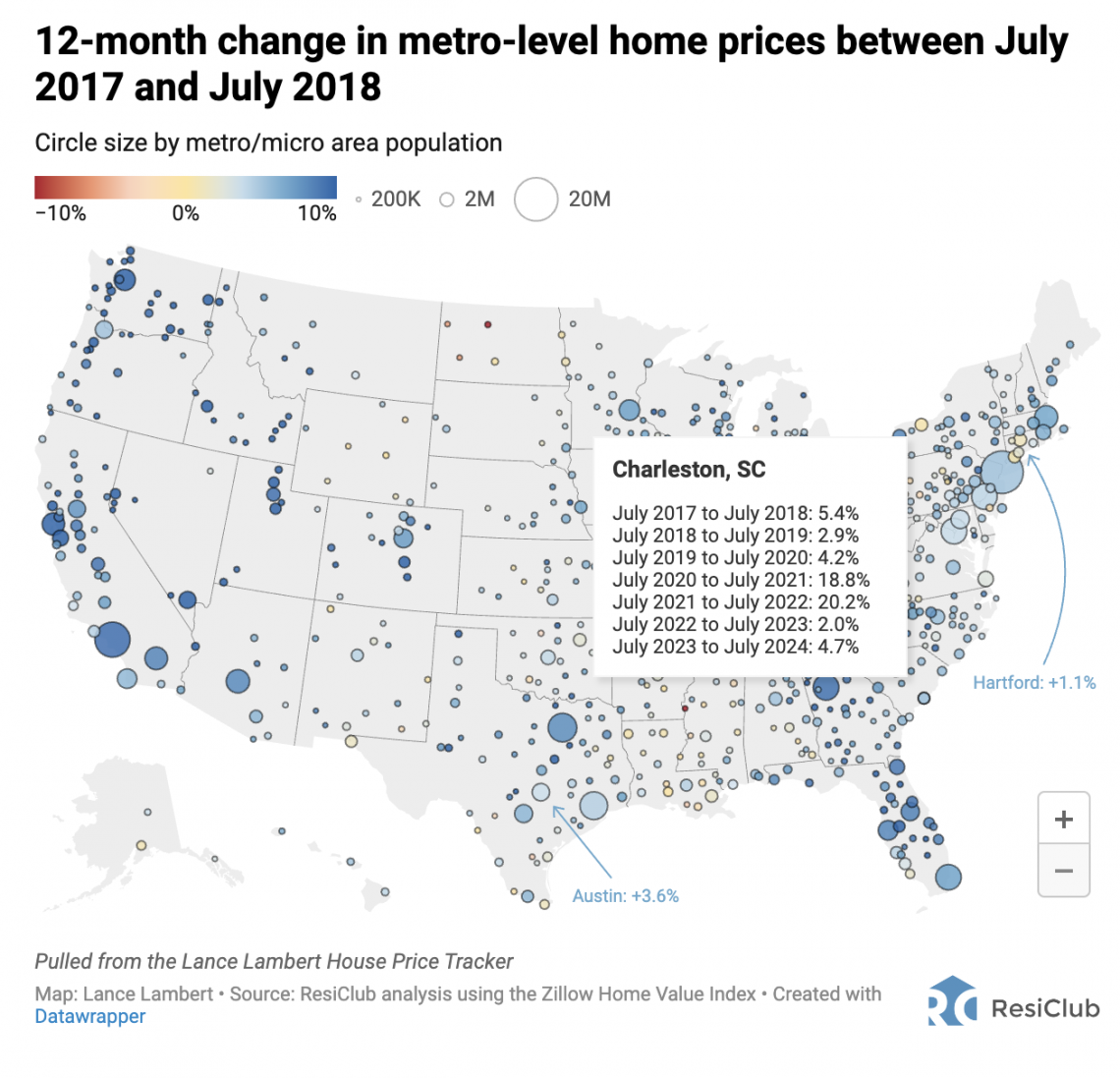

July 2017 to July 2018

Between July 2017 and July 2018, U.S. home prices rose 6.5%.

In the same period, Charleston home prices rose 5.4%.

July 2018 to July 2019

Between July 2018 and July 2019, U.S. home prices rose 4.4%.

In the same period, Charleston home prices rose 2.9%.

July 2019 to July 2020

Between July 2019 and July 2020, U.S. home prices rose 5.5%.

In the same period, Charleston home prices rose 4.2%.

July 2020 to July 2021

From July 2020 to July 2021, U.S. home prices rose 18.6%.

In the same period, Charleston home prices rose 18.8%.

The pandemic marked the beginning of a housing boom that reshaped markets across the country, and Charleston was no exception. For the first time in recent history, Charleston’s home prices began to outpace the national average, driven by historically low interest rates, government stimulus, and the rapid rise of remote work. This surge in demand, combined with shrinking inventory, created a fiercely competitive market. Charleston, with its appealing climate, stunning beaches, rich amenities, and relatively low property taxes, quickly became a top destination for homebuyers looking to relocate during this unprecedented period.

July 2021 to July 2022

From July 2021 to July 2022, U.S. home prices rose 14.8%.

During this same period in Charleston, home prices rose 20.2%.

The trend from 2020 to 2021 persisted, with Charleston’s home prices continuing to outpace the national average as the pandemic-fueled housing boom rolled on. Despite this sharp increase in prices, Charleston managed to avoid the overheating seen in other markets like Austin, TX. However, runaway inflation, driven in part by skyrocketing housing costs, led to a swift rise in mortgage rates. By spring 2022, this upward pressure culminated in the average 30-year fixed mortgage rate peaking at 5.5% on May 6, 2022, according to Mortgage News Daily.

July 2022 to July 2023

From July 2022 to July 2023, U.S. home prices rose 0.4%.

In the same period, home prices in Charleston rose 2.0%.

U.S. home prices saw a modest increase reflecting the cooling effects of rising mortgage rates across the country. In contrast, Charleston’s housing market demonstrated remarkable resilience, significantly outpacing the national average. Despite the continued upward trajectory of mortgage rates, which reached a peak of 7.32% on October 21, 2022, Charleston’s appeal as a desirable place to live and invest remained strong. This steady growth underscores the market’s ability to withstand economic pressures and maintain its attractiveness to both local and out-of-state buyers.

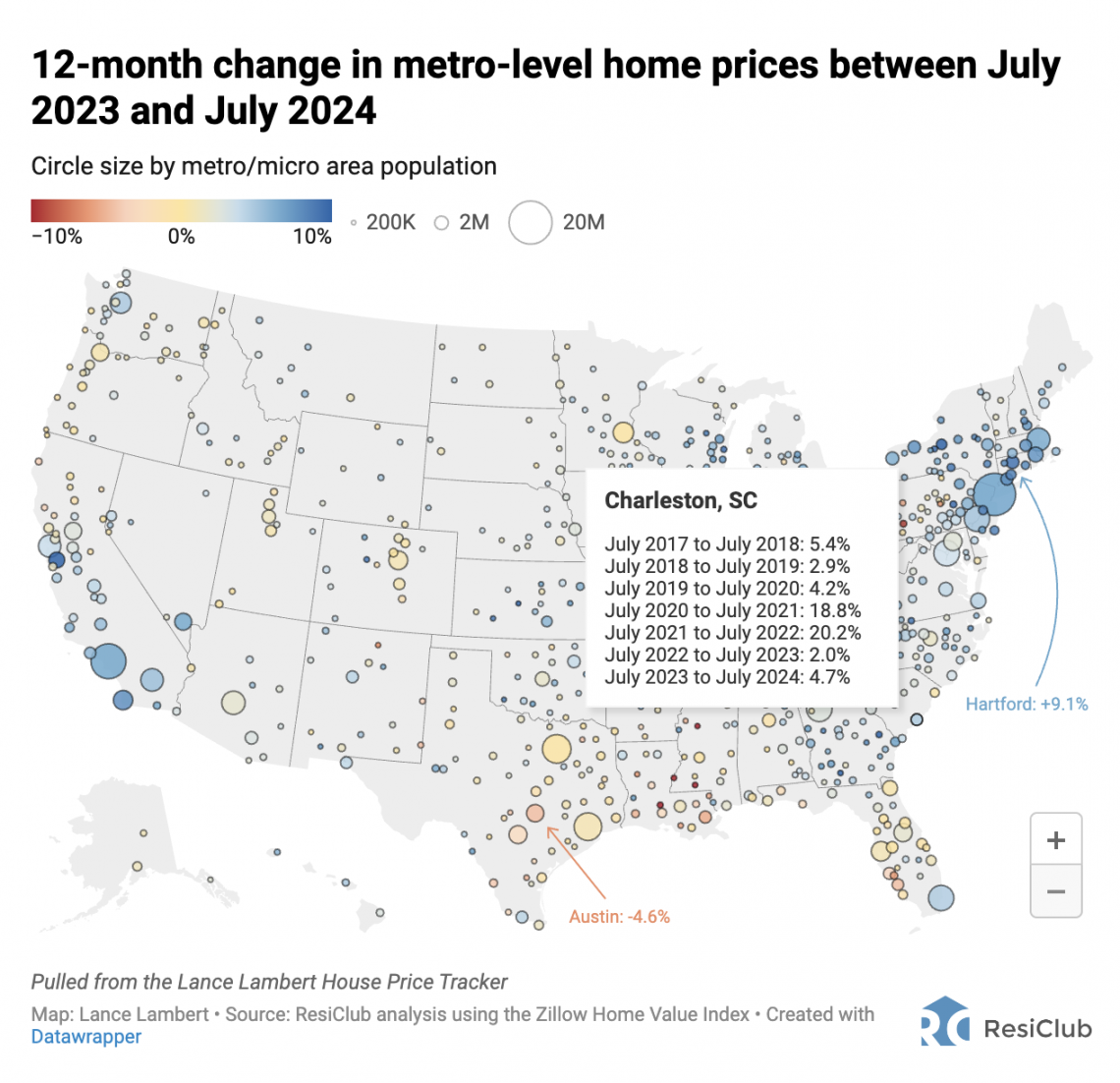

July 2023 to July 2024

From July 2022 to July 2023, U.S. home prices rose 2.8%.

In the same period, home prices in Charleston rose 4.7%.

Affordability remained a significant challenge for homebuyers, even as inventory levels began to gradually increase. For the fourth consecutive year, Charleston’s home price growth outpaced the national average, underscoring the region’s continued appeal. Mortgage rates, however, added pressure to the market, with the average 30-year fixed rate peaking at 8% on October 18, 2023, according to Mortgage News Daily. While rates continued to experience volatility following the fall peak, they eventually settled at 6.7% by July 31, 2024, providing some relief to buyers and sellers.

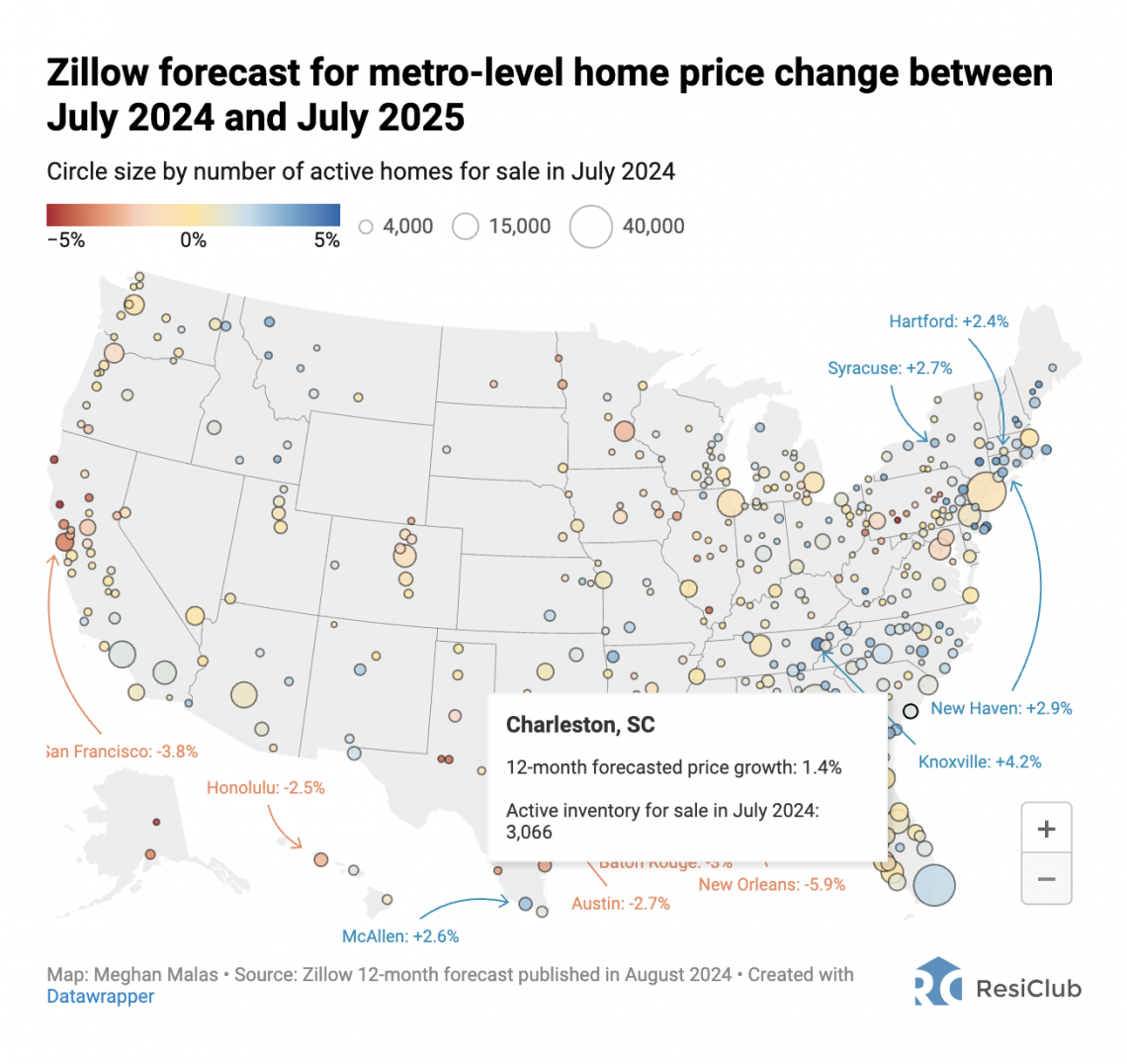

Looking ahead to July 2025

For the next 12 months, Zillow projects that U.S. home prices will rise just 0.9%.

In the Charleston metro area, home prices are expected to rise 1.4% over the next year.

In the Charleston metro area, however, home prices are expected to continue the region’s trend of outpacing national growth for the fifth consecutive year. For homeowners and sellers in Charleston, this is encouraging news, as the market’s strength shows no signs of waning. On the other hand, for prospective homebuyers, the moderation in price appreciation offers some relief. With home prices stabilizing and mortgage rates gradually declining—reaching a national average of 6.37% for a 30-year fixed rate as of August 28, 2024, according to Mortgage News Daily—there is hope that affordability will slowly begin to return to the market.

Which strategy is right for you?

If you’re not sure about the best path forward or want to discuss your specific needs, our team is here for you. Our team of experienced real estate agents is available to assist you with any questions and guide you through the home-buying process.

.png)

_w.png)

.png)